Consumer confidence on Main Street, as measured by the Conference Board, is waning, dipping lower than levels at the height of the shelter-in-place orders in April, in direct opposition to the rapidly improving confidence of Wall Street from the lows in Spring 2020.

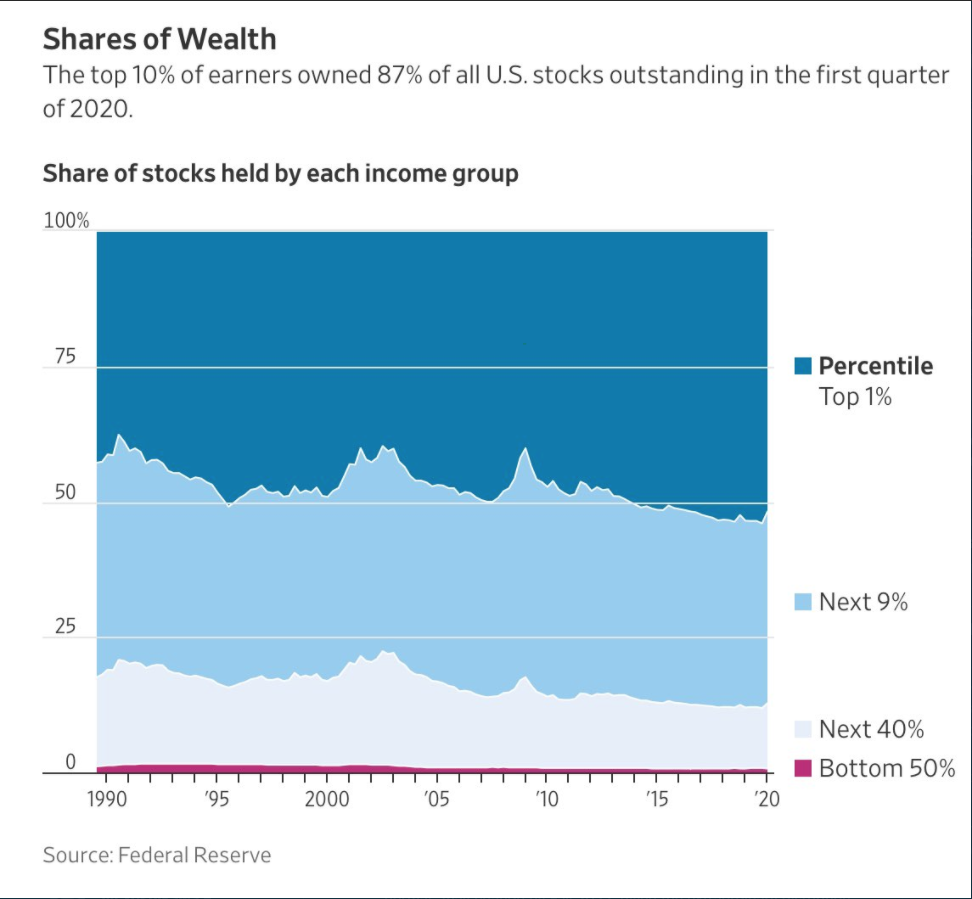

And, yet, that same Wall Street confidence only constitutes 10% of Americans who own 87% of the wares peddled by Wall Street.

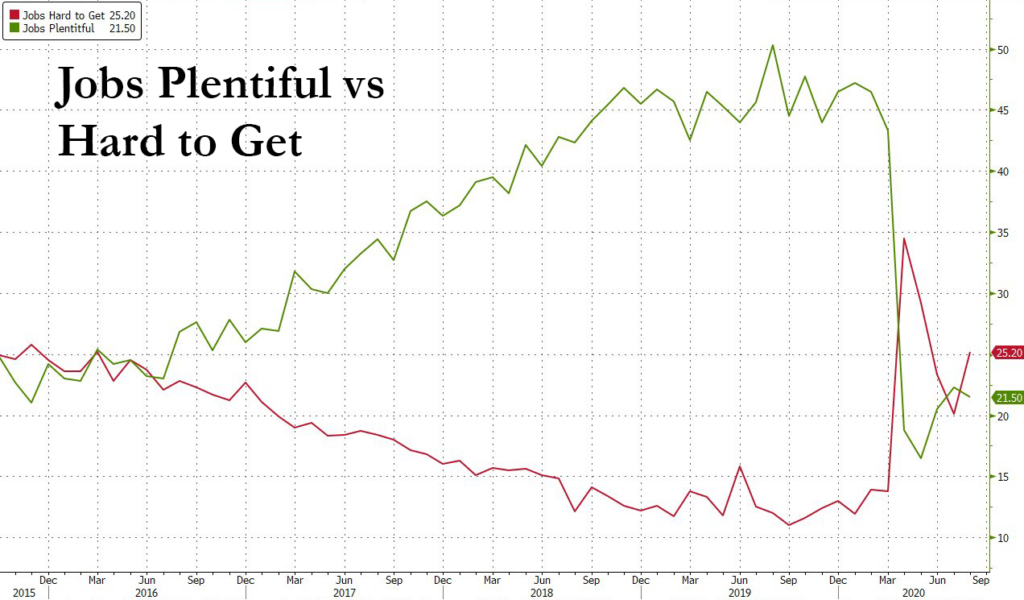

On Main Street, though, the mythical name that defines the place where 90% of the rest of the population lives, the diminishing success of achieving gainful employment may be impacting overall consumer confidence amongst the majority of the American people.

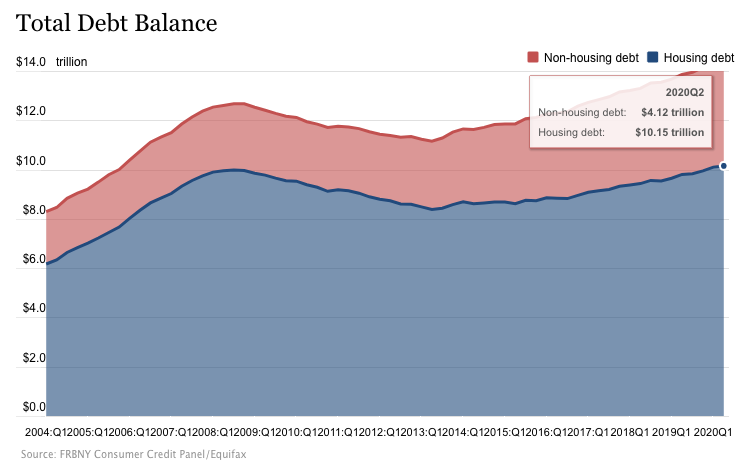

Lacking ownership of the things produced in an economy, combined with the difficulty of finding or maintaining a job, throw in stagnating incomes (which were previously discussed), Americans living on Main Street, if they are to continue playing their roles as consumers in order to drive the American economy forward, may have little choice, but to continue binging on debt, currently totaling $14.3 trillion.

Although Americans may be generally more pessimistic, the young, in a historically predictable way, are increasingly demonstrating their angst on Main Street USA in regular, robust, and at times, even violent protests—whose causes may be more economic and deeply rooted, thus differentiated from the reasoning repeated in the 24 hour news cycle.

For more information about how to both plan for and navigate the complex college admissions process in order to minimize the risk of educational malinvestment, check out Creative Marbles Consultancy.