It’s partisan politics as usual in this election year, as Congress continues its debate on student loan legislation. According to the Wall

It’s partisan politics as usual in this election year, as Congress continues its debate on student loan legislation. According to the Wall

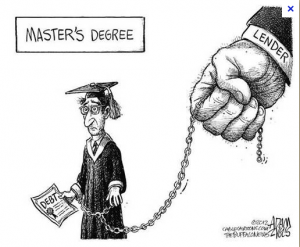

Street Journal, “Republicans on Tuesday blocked the Senate from considering a measure to keep the rate on subsidized federal student loans from doubling amid suspicion of Democrats’ motives as they seek to court the youth vote. The vote was 52-45, short of the number needed to begin debating how to keep borrowing costs for college low for the coming school year. If Congress fails to act, the interest rate will rise on July 1 to 6.8% for loans of as much as $5,500, tacking on more than $1,000 in extra costs over the life of each loan.”

If the recent past is prologue, then at the last minute, Congress will find the ability to compromise and those who have outstanding loans will not see their total student loan outstanding rise beginning July 1, 2012. That said, with political parties playing to their base, the margin for error shrinks and anything could happen. Creative Marbles suggests that readers begin thinking about where in their budget might be the possible extra amount they will have to pay on any outstanding student loan in their possession, if the interest rate rises. As part of this prudent planning process, brainstorm ways to possibly consolidate any outstanding student loan balances, or even fix current interest rates. For those students and families in the process of acquiring a student loan for the first time, look at all possibilities for funding your educational experience besides borrowing, and if borrowing, look at all possible ways to borrow besides just the standard student loan package offered in college financial aid award letters.

The interest rate on government subsidized student loans may not in the end rise this year, but at some point the government will be held accountable for its own years of fiscal imprudence, which will have a fiscal impact on us all, and today is as good as any to begin thinking, and planning, for how we may have to spend less and save more for the things we see as important.