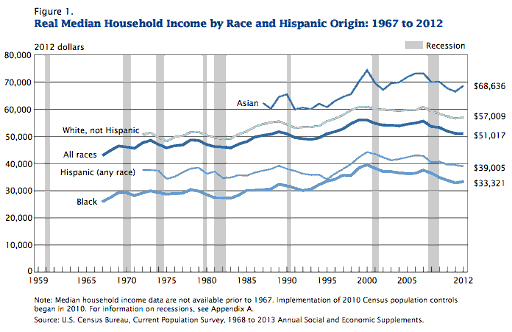

Source: U.S. Census Bureau 2013

The value of college may not be reflected in the cost of college. However, the media attention to average student debt and annually rising college costs can mask the value of college. In addition, when the average costs of goods and services (i.e. inflation) is greater than the average rise in earnings for 99% of Americans since 2009, the costs of college can take on a greater share of a family’s budget, further veiling the value of college. However, the growing difference between median family income and college costs may have an unintended benefit in helping families determine the value of college. While previous generations may have followed a parent or the neighbor kid to a college, “shopping” for a college is becoming more prevalent; spring breaks and summer vacations are often combined with college scouting trips. The more intensive investigation of a college can help families both identify and select the campuses that will provide the greatest value for their limited family budgets. Furthermore, greater financial assistance from a college can result from a thorough college search, that allows college going students to find the campus that will “reward” their efforts from high school with merit scholarships, thus further maximizing family budgets for college expenses. While no one wants less income, the silver lining may be finding creative ways to spend less, and choose the right college that will provide the most value for each student.