Since March 2020, nearly 37.4 million people, or 90% of all student loan borrowers, stopped making payments under the loan forbearance provisions of the CARES Act. Additionally, all student loan interest has been suspended for the past eight months.

However, since the current $900 billion stimulus bill does not extend the forbearance of student loans, the 42 million US borrowers, who collectively owe $1.7 trillion, will likely need to resume payments by the end of January 2021.

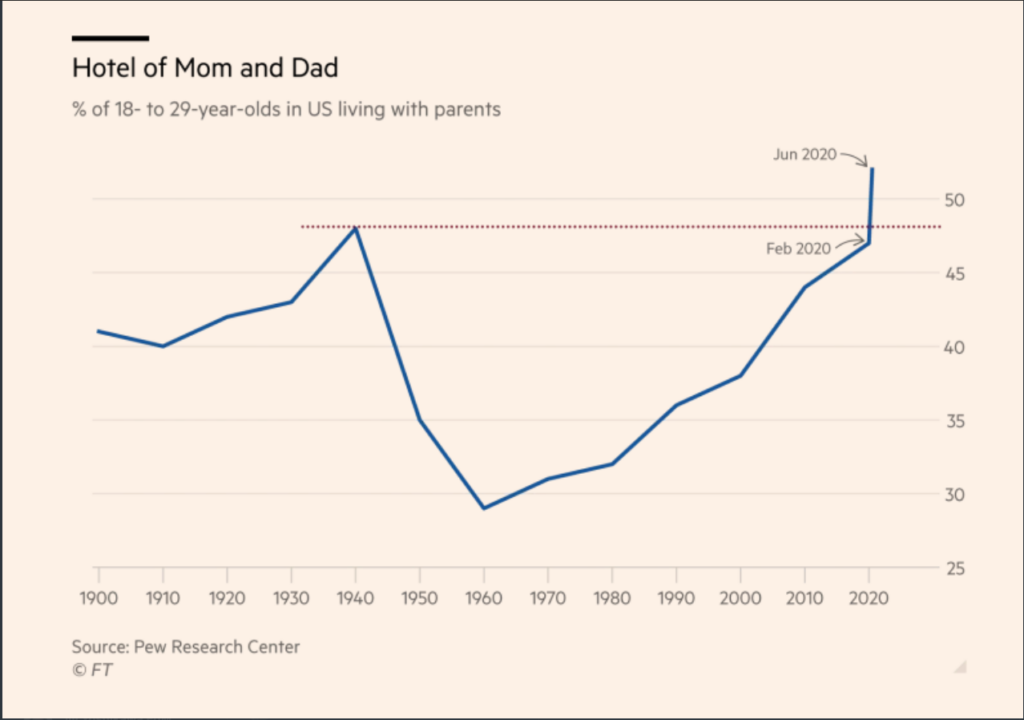

Furthermore, in March 2020, before the CARES Act loan forbearance and the current historic record unemployment, “more than 1 in 4 borrowers [were] in delinquency or default“, as published by CNBC. Thus, with 6 in 10 borrowers stating “it would be somewhat or very difficult to afford their payments if they had to begin making them in the next month” as captured in a recent Pew Charitable Trusts Research survey, then more defaults and delinquencies may be forthcoming, as well as potentially more adult children moving home to live with mom and dad.