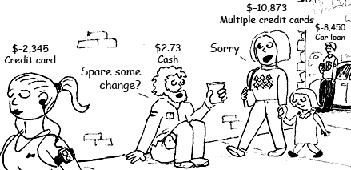

(Click on image to enlarge and see complete comic)

Source: Unknown from the Internet

Now that we understand income, expense and net income–which we arrive at by subtracting expenses from income in any given period–we are now ready to look at the balance sheet, which few understand, but is essential when trying to get a truer understanding of one’s net worth. Everyone’s fiscal interactions with others, which happens everyday of one’s life, can be reduced to a balance sheet. Once we create our own balance sheet and both understand and manipulate it’s components, then we are clearly moving toward fiscal health and the freedom it entails. Let’s begin with a generic understanding of the balance sheet. (Future posts will discuss each part and how can use it as a decision making tool in the short, immediate and long run.)

The balance sheet is made up of assets, liabilities and equity. Actually, the balance comes from the equation A=L+E, or Assets equals Liabilities plus Equities. The balance sheet must always be in balance: the A must = L + E. I like to think of it in another way. Assets are what you have; liabilities are what you owe and equity is what you own; what you have must be equal to what you owe and what you own. It is within the context of this equation, that we start to think about what our effort in life is all about–our net worth, if you will. At any stage in my life, what do I own? What is the value of that which I own? What do I owe and to whom, and how much of what I earn goes to those whom I owe? Do I even still have what I am paying my creditors for? What that I have holds value and what that I have is worthless, but I still hold on to it and why? What is my vision regarding my self-worth (self-esteem) for the future and what must I do, or not do, to achieve that vision? These and other questions come from constructing, evaluating and maintaining one’s personal balance sheet.

All the information we need to construct our balance sheet comes from our profit and loss (or income and expense) statement/budget that we discussed in earlier posts in the series, and a review (or inventory) of what you already have–that is either owed or owned along with a approximate value. Again, we will break down the balance sheet in future posts discussing more about what each element means and how it can be defined within the context of one’s own finances. See you next time, and until then, remember nothing ever happens in a vacuum.

Here are other installments in the ongoing Prudent Fiscal Planning Series:

Part 1: Prudent Fiscal Planning is Essential in Todays Economical Turbulent World

Part 2: Prudent Fiscal Planning: Incomes Importance in Fiscal Planning and Its Effect on Our Standard of Living

Part 3: Prudent Fiscal Planning: You Can’t Always Get What You Want

Part 4: Prudent Fiscal Planning: To Save or Not to Save that is the Question

Part 6: Prudent Fiscal Planning: What I Really Own

_____________

Art Baird, a former high school teacher-whose academic work is in business and economics-continues to study economic and financial theory, as well as micro and macro economic/finance issues of the day, when not playing his role as one founding partner in Creative Marbles Consultancy. You can contact Art at art@creativemarbles.com or, read his short biography.

_____________

Picture Source: Unknown from the internet