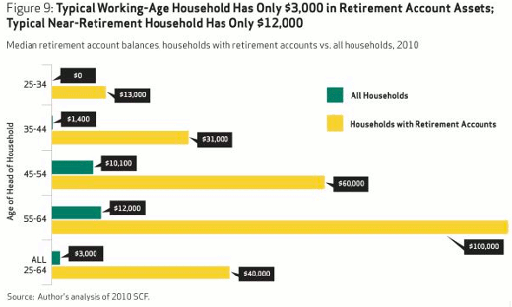

Worries about paying for rising college costs can be compounded by concerns over saving for retirement. As seen in the chart below, with average retirement savings of people aged 45-54, the general age range of parents with college-aged children, at $10,100, can explain parents’ concerns. The Baby Boomer group just ahead in age (55-64) has only accumulated $2000 more, on average–not creating much more security.

Retirement savings and college expenses can seem to be competing interests within one family budget, especially as median incomes are lower than 5 years ago. However, planning forward and having frank conversations amongst the entire family can help both parents and children achieve their goals.

For more information, see our previous guest post by Certified Financial Planner, Cynthia S. Meyers

Photo Credit: The Burning Platform Blog