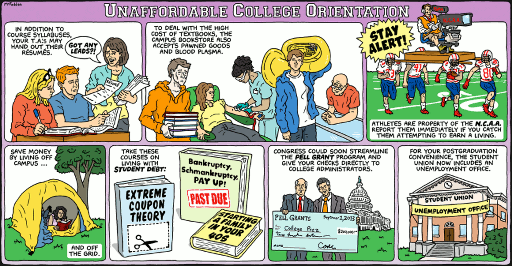

A tongue-in-cheek look at rising college costs, yet gives another incentive for college bound teens to think thoroughly about their college choices.

The value of college as a traditional gateway to long term financial security and a career may be shifting. Students would be wise to think through job prospects for particular majors, as well as the effectiveness of the career services available to guide students throughout their college experience with internships and other work experience. Secondly, the continued annual increase in college costs can include textbooks and healthcare, in order to reasonably budget for college expenses. Renting textbooks can offer an alternative to purchasing thousands of dollars of textbooks that will only be used once. Furthermore, planning for housing costs can depend on location, e.g. New York City may cost more than living in Des Moines, IA. Students can ask about average rents and housing availability, while researching colleges for application. Lastly, the fiscal health of the university can also influence the cost of attendance, as well as dependence of the university on local, state and/or Federal subsidies, like many public universities, to keep student tuition low.

On the paying for college side, financial aid, that is actually aid as we discussed last week, may include conditions on scholarships and other grant aid (i.e. money that doesn’t need to be paid back) in order to receive the same amount each year. Common conditions are registering and completing units equivalent to full time status, and maintaining a minimum GPA. While student loans help pay for college in the short term, student debt is nearly impossible to discharge in bankruptcy proceedings and the Federal government has the powers to garnish wages, Social Security benefits for retirees, and tax returns to collect the amount past due.

With foresight, college bound students and their families can consider all the options for a higher education and find a valuable, affordable college experience. As always, starting with what an individual student knows about himself/herself is the first consideration. THEN, match the college to the student. Too often students only consider colleges where they may be admitted, giving the power to the college, rather than thinking,”Which college deserves my 4 years of time and tens of thousands of dollars in tuition?” Only in thinking through what the student wants from a college, can a valuable match be made and the investment in college become more affordable.

Photo Credit: New York Times, September 1, 2013