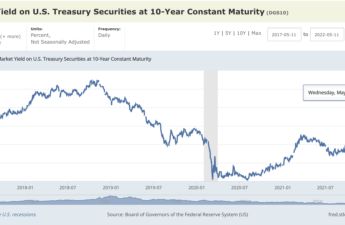

Each July, Federal student loan interest rates are reset for the upcoming school year using the formula of 10-Year Treasury Rate + 2.05%. Currently, as of today, May 12, 2022, with the recent .5% interest rate increase, the 10 year Treasury interest rate is 2.91%. Thus, although the Federal student loan interest rates are fixed…

Tag: Student Loans

The Extra Bonus of the Student Loan Repayment Pause through May 1, 2022

Since March 2020 and extending through May 1, 2022, payments and interest on all Federal education loans, both student loans and Parent PLUS loans have been suspended as parts of various COVID-related economic relief policies. Borrowers have not been obligated to send payments, and for anyone already behind in their payments, no additional penalties have…

The search for merit aid begins with the proper valuation of a college degree

“Do you help with scholarships?” is often one of the first questions that parents ask me. Fearful of the ever-increasing cost of college tuition, they (mis)perceive a college education as a large purchase, rather than an investment. To invest in a college education, both institution and family mutually consent to a partnership. Yet, in any…

Why the May 13, 2021 10 Year Treasury Auction Matters to Student & Parent Loan Borrowers

Federal student loan interest rates, the cost of borrowing money to be paid at a fixed rate over the life of the loan, are set by adding 2.05% for undergraduate loans to the 10 Year Treasury Rate after the last May auction each school year. [For the upcoming 2021-22 school year, loan interest rates will…

Student Loan Forbearance to End

Since March 2020, nearly 37.4 million people, or 90% of all student loan borrowers, stopped making payments under the loan forbearance provisions of the CARES Act. Additionally, all student loan interest has been suspended for the past eight months. However, since the current $900 billion stimulus bill does not extend the forbearance of student loans,…

Teenage Unemployment Blues

Many high school and college students, who are normally camp counselors, are unemployed as many in-person and residential summer programs were cancelled. While a financial deficit for many students in the short term, cascading consequences may also affect students’ prosperity in the long term. On May 24, Patrick Thomas of The Wall Street Journal wrote…

Delicious Student Loan Relief

While Mom always warns us not to eat too much fast food, Burger King’s recent offer may change her mind. Given the historically record setting $1.5 Trillion total student loan debt, Burger King is offering 301 of the 44 million Americans with student debt some relief–up to $100,000 for one lucky person and $500 each…

Does a Free Lunch Exist?

Here’s how to borrow $127,000 in student loans, only repay $87,000 over twenty years, and have the U.S. Government pick up the tab for the $450,000 still owed at the end of the repayment period. [Notice the quadrupling effect on the total balance owed because of the interest that accrues in the two decade long repayment period?…

Living with Mom & Dad?

Is the trend shown in the chart below, caused by the increase in student loans, as seen in the following chart? Charts Courtesy: Goldman Sachs Global Investment Research & Zero Hedge, October 26, 2014

Why Winning Free Money Takes Effort

Scholarships are not mysterious. Winning them takes work – which is only a continuation of the efforts to be eligible to compete for scholarships in the first place.

College Costs: Myth vs. Reality

A tongue-in-cheek look at rising college costs, yet gives another incentive for college bound teens to think thoroughly about their college choices.

Is College Financial Aid Really Aid?

The difference between the value of college, indicated by price and intrinsic worth, and what a family feels they can afford to pay creates the need for financial aid. But, college bound buyer beware: NOT ALL FINANCIAL AID AWARDED BY THE UNIVERSITY IS ACTUALLY AID.