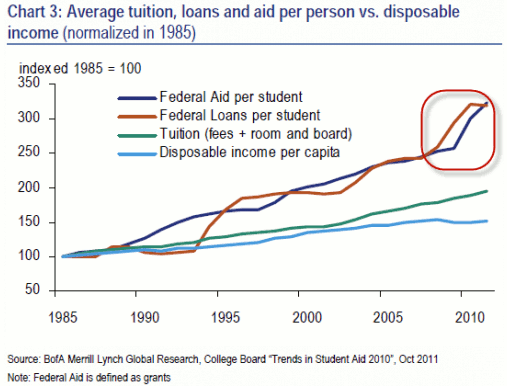

Wondering why college seems more costly than in the past? According to the U.S. Bureau of Labor Statistics, college tuition has increased 559% since 1985. Over the same time, disposable income has increased only incrementally, which can create the perception of greater costs for each family.

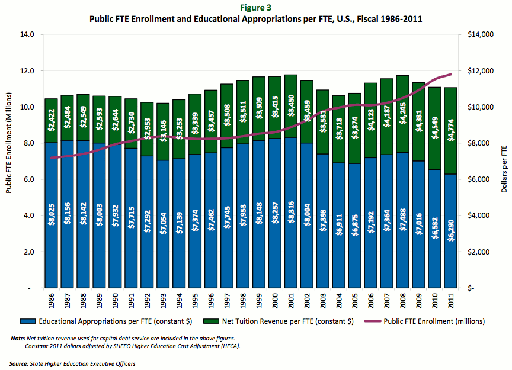

Also, state support for publicly funded universities has decreased shifting the costs of higher education to families and students, while total enrollment at public universities across the U.S. is steadily increasing (indicated by the red line.) So, a college education is costing more, while there’s greater demand for services, classes, advising and jobs. The New York Times recently reported that more jobs are requiring a college degree to be considered for hiring; the same jobs that in the past did not require a college education–without an increase in pay.

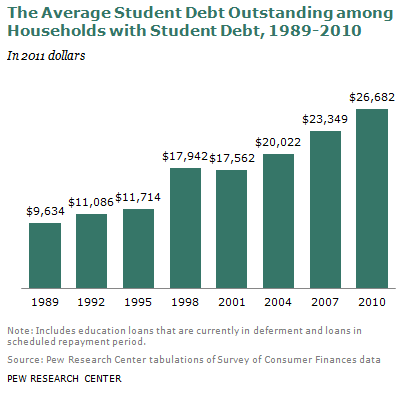

At the same time that families are bearing more of the costs of college, student borrowing has been increasing. The Pew Research Center reports that 19% of American households carry student loan debt:

At an average of $26,600 of student debt amongst all borrowers in 2011. The average increases annually.

For families seeking college admissions, while saving more to pay out-of-pocket for college expenses may not be a cure-all, find the most valuable college experience for any debt parents and students may assume, as well as for any savings that will be consumed by college tuition.