Not all student debt is ruinous. However, borrowing can be complex. Loans spend tomorrow’s income today, and for college students, a promise of tomorrow’s income is spent to pay for expenses in the present day. Understanding recent growth in student loans and the challenges of repayment can help potential student loan borrowers consider both the benefits and the risks before borrowing.

For the last 30 years, college tuition is increasing greater than other consumer goods and services:

In addition, median household income is relatively flat in growth over the same time period:

The difference between tuition and resources to pay for college may be a reason for student loan borrowing rates increasing:

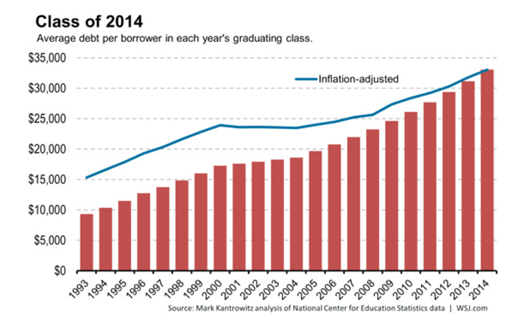

Not only are more students borrowing, the average amount borrowed per student is rising:

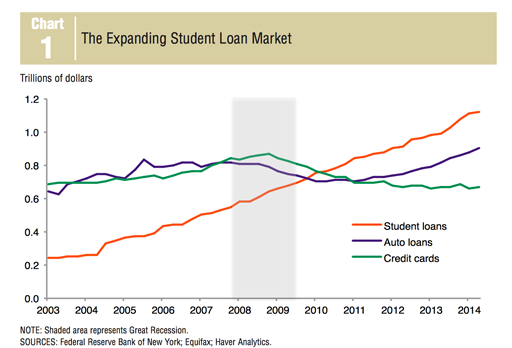

Thus, the total amount of student loan debt in the United States is at $1.3 Trillion and growing—greater than both auto loans and credit card debt:

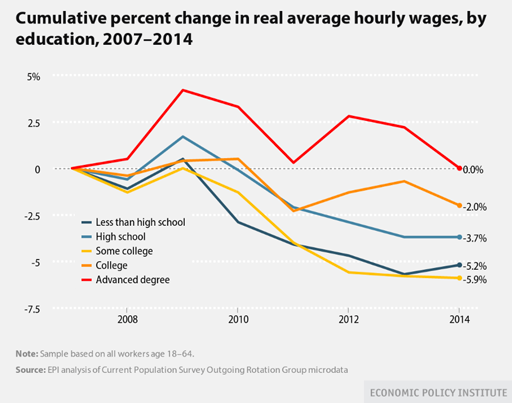

Yet, even amongst educated workers, wages are declining, as seen below, which creates pressure when repaying loans:

Given the decrease in wages, yet being obligated to repay loans from the past, almost a third of all student loan borrowers have defaulted, according to the St. Louis Federal Bank. In addition, the most recent student loan borrowers’ cohort is defaulting earlier in their repayment period than previous groups of borrowers:

The moral of the story:

Borrowing to pay for college expenses may be necessary. With a thorough analysis of the costs and benefits of borrowing, college students can plan prudently, and not graduate burdened with debt in the future.