We’re officially in a recession, meaning GDP, or the total value of goods produced and services provided in the US during a single year has declined for two consecutive quarters.

The world economy is expected to contract by 5.2% this year—the worst recession in 80 years—but the sheer number of countries suffering economic losses means the scale of the downturn is worse than any recession in 150 years, the World Bank said in its latest Global Economic Prospects report.

Heather Scott, Agence France-Presse (AFP), June 8, 2020, Credit Bubble Bulletin, June 13, 2020

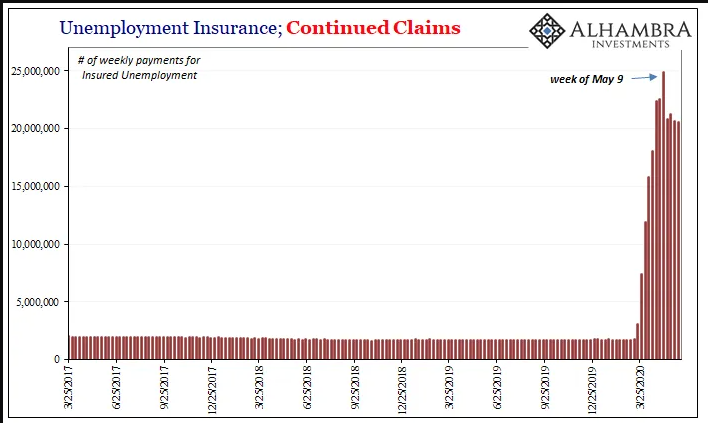

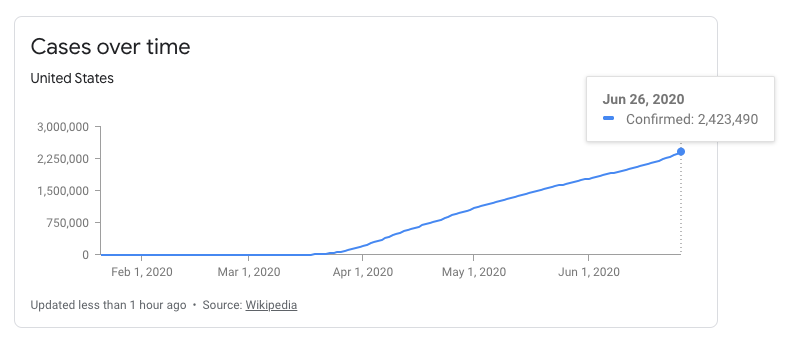

The historical economic contraction that began in March 2020 has led to a historic shedding of jobs.

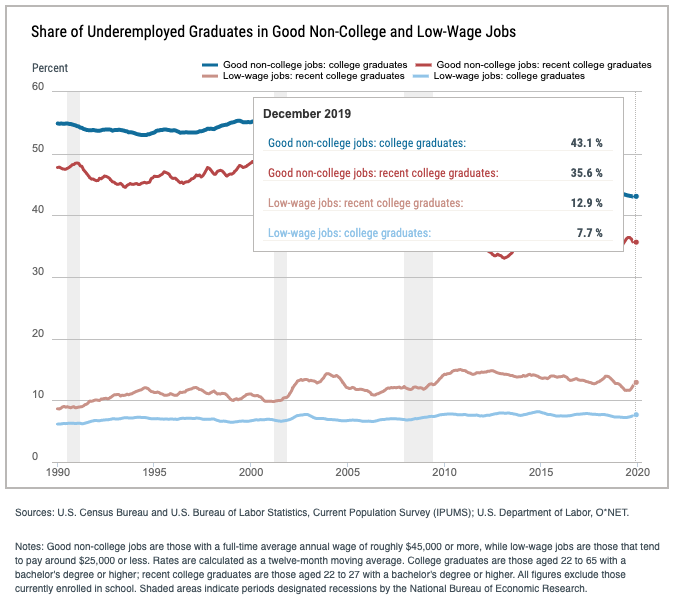

Now, competing with masses of unemployed, including 22 million individuals currently collecting unemployment benefits, seeking to maintain their standard of living and hoping to be rehired by employers or find gainful employment elsewhere, are new college grads, aged 22-27, who were already struggling even before the COVID-19 induce economic shutdowns, to gain meaningful employment concomitant to their educational accomplishment. Furthermore, these same 22-27 year olds are now competing for jobs with the millions of workers whose hours were cut or wages declined due to the economic upheaval.

Even before the COVID-related economic shutdown which started in March 2020, those new college grads, aged 22-27, were confronted with a crisis of underemployment, working in jobs that didn’t require college degrees, according to February 2020 Federal Reserve statistics.

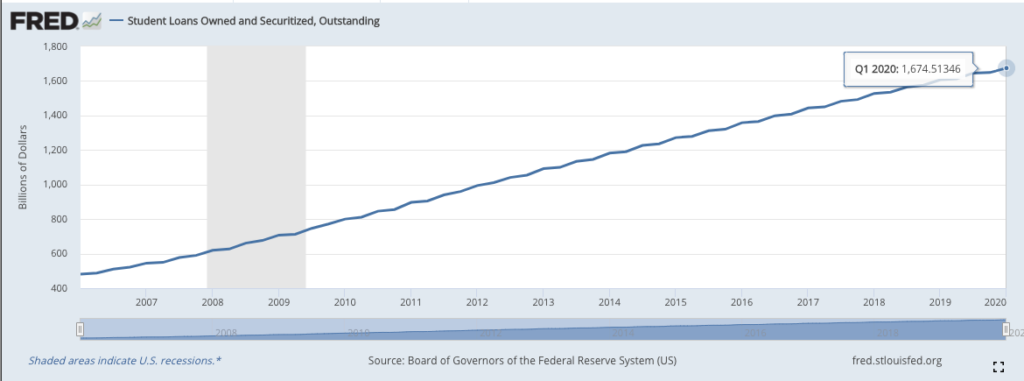

New college grads aged 22-27 cohort depended upon parents’ or some other patron’s savings to pay annually-increasing college costs or were forced to leverage their future earnings or the earnings of someone else in the form of student debt which if used to fund a college education based on an ineffective education investment strategy can be ruinous.

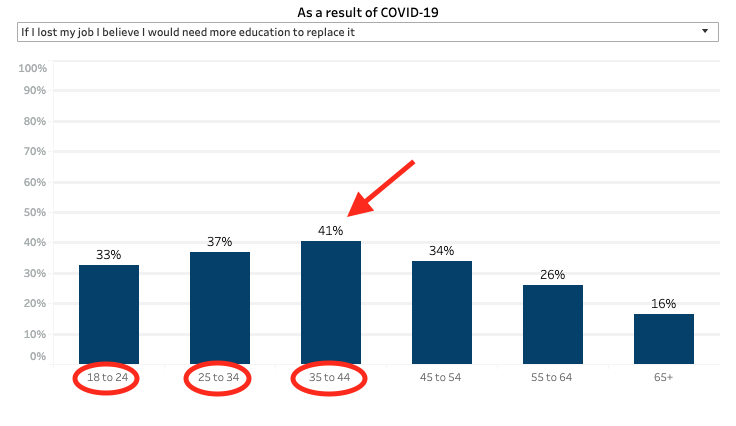

Will that 22-27 year old cohort, possibly laden with unmanageable debts, now be forced back to school for more education or training in order to be competitive in the radically shrinking job market, only validating a college malinvestment by not initially aligning their educational pursuits with an inherent aptitude?

Making employment prospects worse is the possibility that we will not experience a V-shaped economic recovery as many pundits and economists have suggested. As Jeff Snider of Alhambra Investments quotes IHS Markit:

Any return to growth will be prone to losing momentum due to persistent weak demand for many goods and services, linked in turn to ongoing social distancing, high unemployment and uncertainty about the outlook, curbing spending by businesses and households. The recovery could also be derailed by new waves of virus infections.

Not COVID-19, Watch for the Second Wave of GFC 2, June 23, 2020

The possibility of a slower return to economic growth and the end of the recession is predicated on the idea that consumers concerned about becoming sick or by government decree aren’t allowed to spend money to the same degree as before the onset of the current economic contraction, then businesses in an attempt to maintain profitability will likely look to cut their greatest cost more, which is labor, only further exacerbating the employment woes of the 22-27 year old cohort.

Thus, for younger students and their parents soon to confront the reality of an increasingly competitive employment market, distinguishing oneself amongst the myriad of job candidates will be essential for individuals to win that coveted job, which will be less about the whims of the labor market and more about the validation of one’s inherent skill that will always be in demand no matter how difficult economic times become.

For more information about how to navigate the complex college admissions process to prepare any student for the challenging labor market, check out Creative Marbles Consultancy